ADVANCE YOUR CAREER IN FINANCE BY TAKING THE FRM COURSE

INTRODUCTION

The Financial Risk Manager (FRM) course is an internationally recognized certification program for professionals in financial risk management. The FRM program is intended to give candidates in-depth knowledge of the various types of financial risks as well as the tools and procedures used to manage them. It’s a great certification if you want to build your career in core finance. The Global Association of Risk Professionals (GARP) offers the FRM program.

FRM COURSE DETAILS

Full-Form | Financial Risk Manager |

Website | |

Status, of Course, | It’s a Designation |

Age Limit | There’s no age limit |

FRM Course Fees | 2.5-3 Lakhs |

Job Profile |

|

FRM Salary in India | Highest Salary – 12-20 LPA Average Salary – 6-10 LPA |

*Note there is no other authorized institute for FRM except GARP

FRM COURSE ELIGIBILITY CRITERIA

FRM courses can be pursuaded after the 12th grade, but it is usually advised in the second year of graduation. As the person develops more knowledge about finance and the risks involved.

FRM COURSE SYLLABUS

FRM PART I

SUBJECTS |

|

PAPER PATTERN | There are 100 MCQs (Multiple Choice Questions) to be answered in 4 hours.

|

FRM PART II

SUBJECTS |

|

PAPER PATTERN | There are 80 MCQs (Multiple Choice Questions) to be answered in 4 hours

|

FRM COURSE DURATION

The course typically lasts 1-2 years, however, this is determined by the individual’s study habits. Before proceeding to FRM level 2, the candidate must first pass FRM level 1. The qualification requires a minimum of two years of experience. It also depends on a variety of criteria, including the complexity and depth of information required to understand the material.

FRM EXAM

Part I and Part II of the FRM Exam take place three times a year in the months of May, August, and November.

- Registration for the August attempt opens in the first week of March.

- and for the November attempt, registration opens in the first week of May.

Remember The fees you have to pay are directly impacted by the FRM Course Registration.

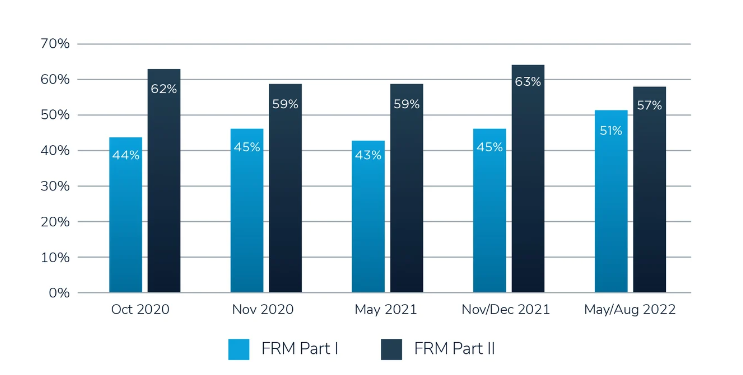

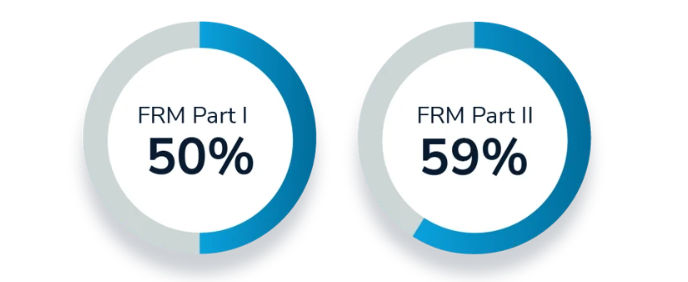

PASS RATES

NOVEMBER PASS RATE

CONCLUSION

The FRM Course is a continuous procedure that requires a thorough understanding of an organization’s finances and the risks involved. The FRM designation is difficult to obtain, but it can help you grow in your profession. You can advance to the position of CFO With the help of FRM certification. advance your career in core finance with the help of FRM Certification.

FAQs ( Frequently Asked Questions )

Yes, you can pursue FRM Course after 12th.

It is around 2.5 Lakhs to 3 Lakhs

Average FRM Salary in India is 6-10 LPA